National Tax Number (NTN) is a mandatory requirement in Pakistan’s modern tax system for individuals and businesses earning taxable income. It serves as your official identification with the Federal Board of Revenue (FBR) and allows you to become a registered tax filer. With an NTN, you can legally file income tax returns, open and maintain business bank accounts, and avoid higher tax deductions applied to non-filers. Salaried persons, freelancers, consultants, entrepreneurs, and companies all need NTN registration to operate smoothly and lawfully. Obtaining an NTN not only ensures compliance but also builds financial credibility and opens doors to new business and investment opportunities.

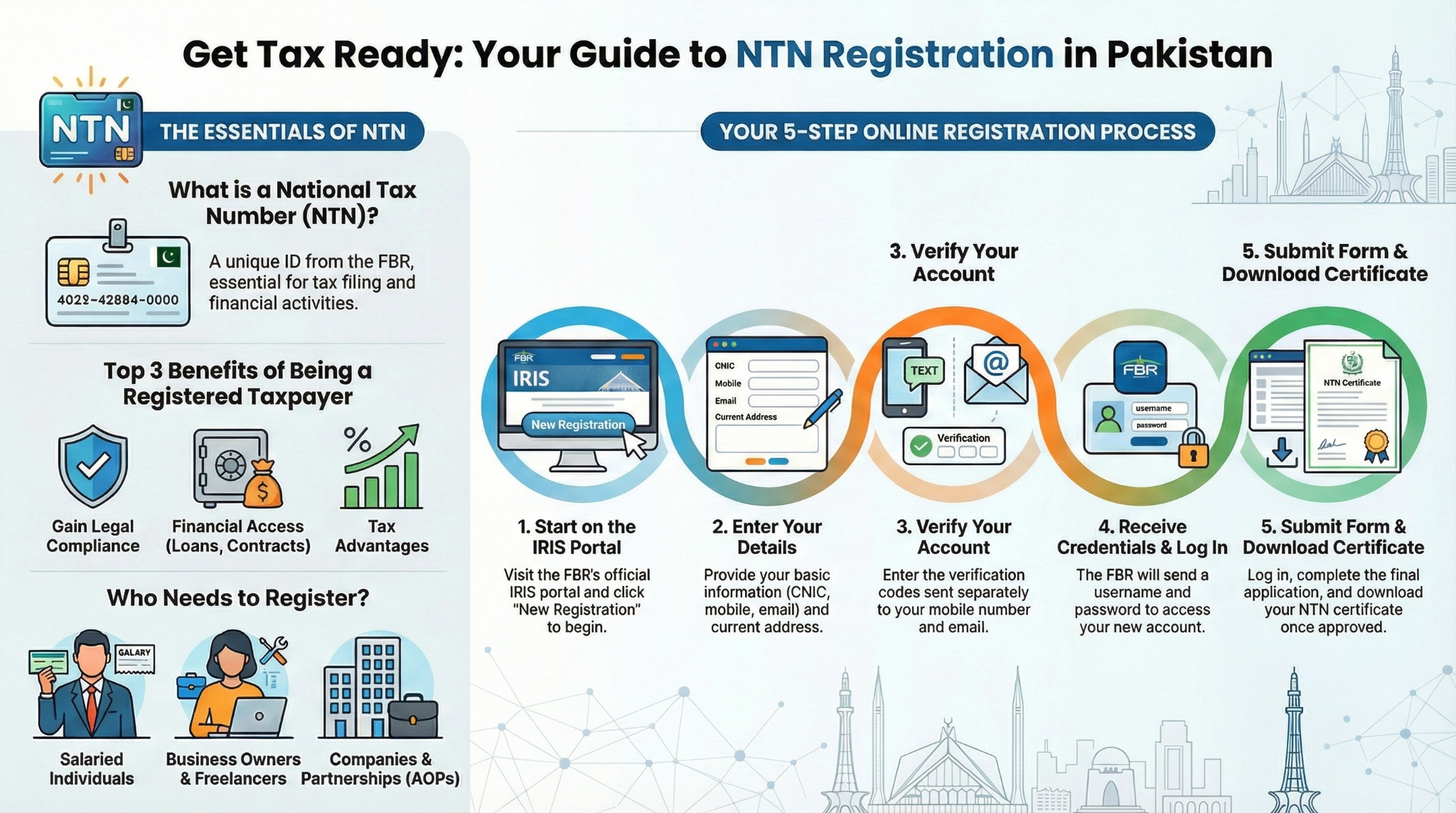

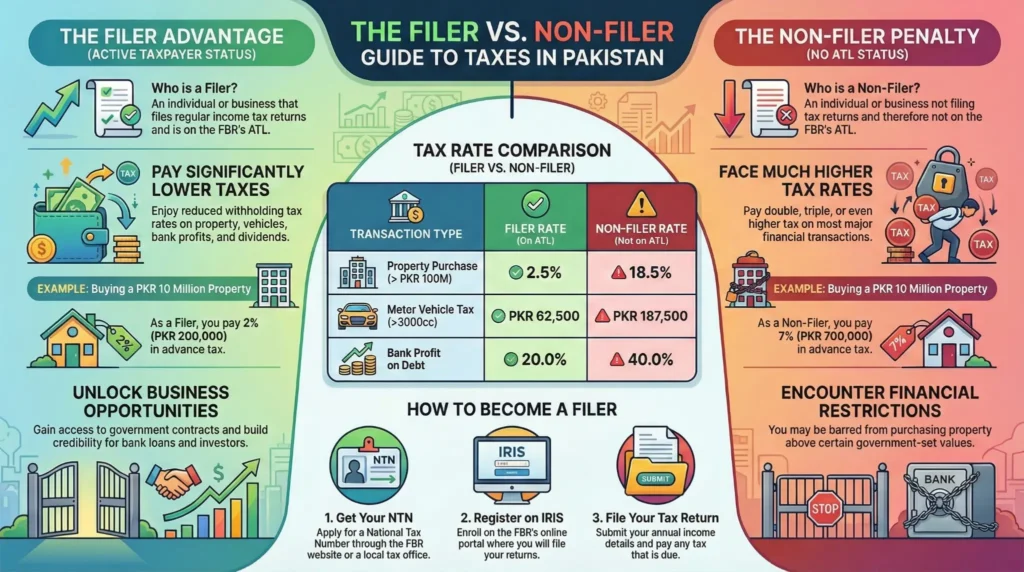

A National Tax Number (NTN) is a unique identification number issued by the Federal Board of Revenue (FBR). It identifies a taxpayer within Pakistan’s tax system and records all tax-related activities under one profile. Having an NTN provides multiple benefits. It reduces tax deductions on income, improves business credibility, enables property and vehicle registration, and allows individuals and companies to remain legally compliant. Without NTN registration, individuals are considered non-filers, which results in higher tax rates and legal complications.

NTN registration in Lahore is mandatory for a wide range of individuals and entities, including:

If you reside in Lahore and earn income from any source, NTN number registration confirms your compliance with Pakistan’s tax laws.

The FBR NTN registration process is now primarily digital. FBR offers a convenient online NTN registration system, allowing taxpayers to register from anywhere in Pakistan without visiting an office. However, individuals facing documentation issues or technical challenges may still visit FBR facilitation centers in Lahore for assistance. Online registration remains the fastest, safest, and most efficient method.

Access FBR Iris Portal

Visit the official FBR Iris system to begin your NTN registration online Pakistan. The portal allows both individuals and businesses to create tax profiles.

Create an Account

Register using your CNIC (for individuals) or SECP details (for companies). Your email address and mobile number will be verified through OTPs.

Complete Profile Information

Provide accurate personal or business details, including address, income sources, and employment or business nature. Correct data entry is critical to avoid registration delays.

Submit Required Documents

Upload scanned copies of required documents, such as CNIC, utility bill, business proof, and bank account details.

Submit Application

Once all information is completed, submit the form. FBR will review your data and issue an NTN upon approval.

To complete FBR NTN registration online, you typically need:

For companies, SECP incorporation certificates and NTN of directors may also be required.

One of the biggest advantages of NTN registration online Pakistan is that FBR does not charge any official fee. The NTN registration fee is zero when applying directly through the FBR portal. However, professional tax consultants may charge service fees for handling documentation, submission, and follow-ups. These charges vary depending on complexity and urgency.

After submitting your application, you can perform an NTN registration check through the FBR website.

NTN Registration Check Process:

1. Visit FBR’s NTN verification page.

2. Enter your CNIC or business details.

3. View your NTN status instantly.

This tool helps confirm whether your NTN number registration is complete or still under review.

Once approved, FBR issues a digital FBR NTN registration certificate. This certificate is essential for bank documentation, contracts, and official use.

How to Download NTN Certificate:

The certificate contains your NTN number, name, and tax profile details.

Obtaining NTN provides long-term financial and legal advantages:

For professionals and businesses in Lahore, NTN registration strengthens financial credibility.

Many applicants face delays due to avoidable errors. These include incorrect CNIC details, mismatched addresses, missing documents, and incorrect income category selection. Double-check all information before submission to confirm faster approval.

While the online NTN registration process is user-friendly, many individuals prefer professional assistance to avoid errors and save time. Tax consultants in Lahore provide end-to-end services, including registration, verification, certificate issuance, and tax filing support. Professional services are especially helpful for freelancers, startups, and businesses with complex income structures.

Understanding how to get NTN from FBR is essential for anyone earning income in Pakistan. With FBR’s digital platform, NTN registration in Lahore has become faster, transparent, and cost-effective. By completing FBR NTN registration online, downloading your NTN registration certificate, and staying compliant, you protect yourself from penalties while unlocking financial opportunities. Whether you register independently or with professional help, obtaining your NTN is a critical step toward a secure financial future.

We empower businesses across Pakistan with secure, efficient, and regulation-ready billing solutions, making tax compliance simpler, faster, and smarter.

© 2025 Tax Jar. All Rights Reserved

WhatsApp us