Filing a tax return is an essential financial responsibility for individuals and businesses alike. Whether you are a salaried employee, freelancer, or business owner, understanding how income tax, tax refunds, and online tax filing work can save you money, time, and stress. With digital systems improving worldwide, taxpayers can now file tax returns online, track refunds, and even pay taxes online with ease. This comprehensive guide explains everything you need to know about income tax return filing, eligibility, benefits, and best practices for individuals and businesses.

A tax return is an official document submitted to the tax authority that reports your income, expenses, deductions, and taxes paid during a financial year. Based on this information, the tax department determines whether you owe additional income tax or are eligible for a tax refund. Filing a tax return is not just a legal requirement; it also serves as financial proof for loan applications, visa processing, and business compliance.

Income tax is a mandatory contribution paid to the government based on your earnings. It applies to salaries, business profits, rental income, investments, and other sources. Proper income tax filing ensures transparency, national development, and compliance with tax laws. Failing to file an income tax return can result in penalties, legal notices, and loss of financial credibility. Regular tax compliance builds a strong financial record and protects you from future complications.

You should file income tax return if you fall under any of the following categories:

Those required to maintain a tax record for legal or financial purposes

Even if your income falls below the taxable limit, filing a tax return online can still be beneficial for documentation and refund claims.

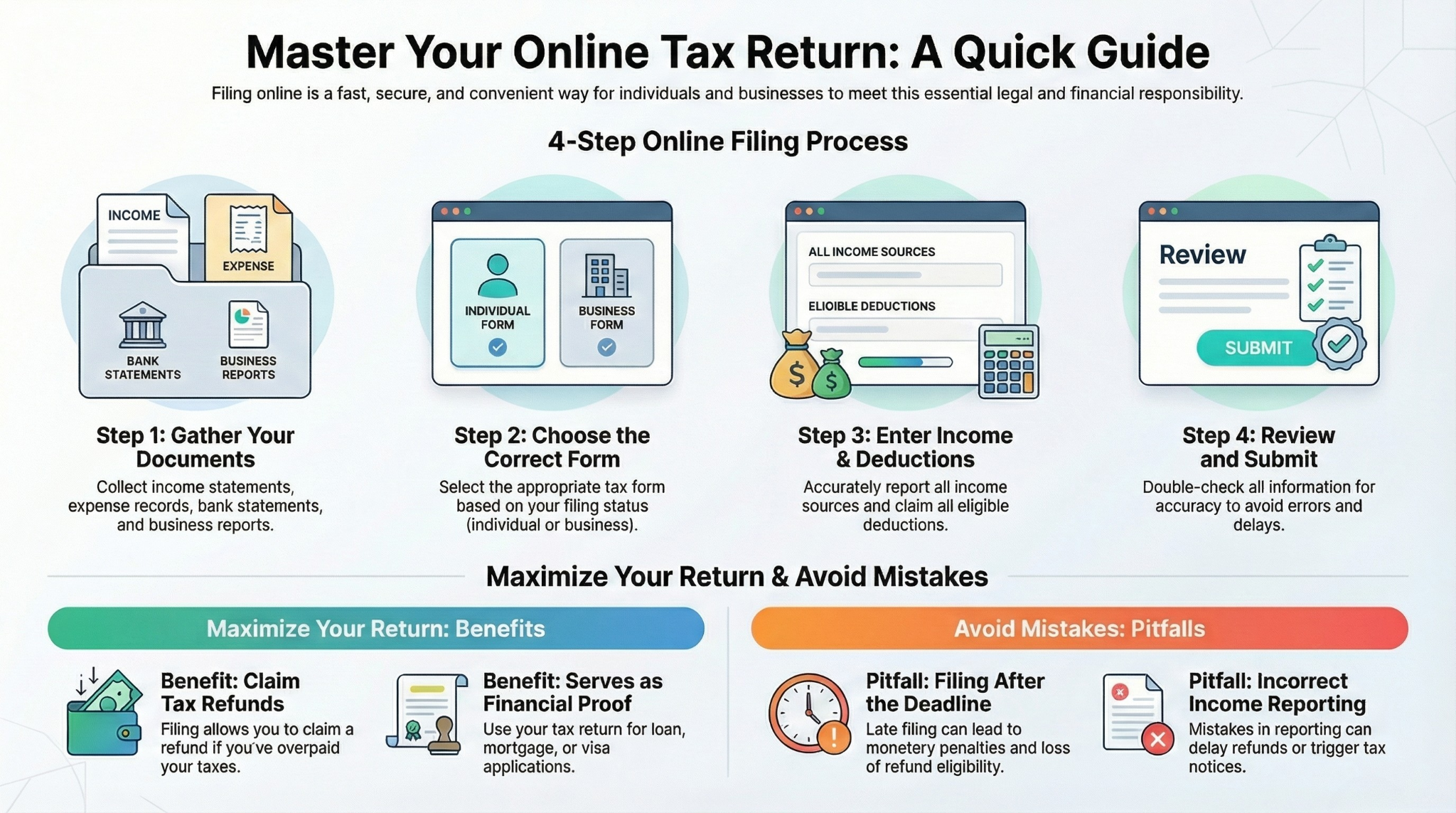

Filing your income tax return offers multiple advantages beyond legal compliance.

Claiming Tax Refunds

If excess tax has been deducted from your income, filing a tax return allows you to claim a tax refund directly into your bank account.

Financial Proof

An income tax return acts as verified proof of income, useful for loans, mortgages, and visas.

Avoiding Penalties

Timely income tax filing helps avoid late fees, fines, and legal actions.

Business Growth Support

For entrepreneurs, consistent business tax filing enhances credibility with investors and financial institutions.

Thanks to digital platforms, you can now file tax return online without visiting tax offices. Online filing is faster, secure, and user-friendly.

Step 1: Gather Required Documents

Before you file income tax return, collect documents such as:

Step 2: Choose the Correct Tax Form

Select the appropriate form based on whether you are filing as an individual or reporting business tax.

Step 3: Enter Income and Deduction Details

Accurately report all sources of income and applicable deductions to calculate your income tax correctly.

Step 4: Review and Submit

Double-check the information before submitting your tax return online to avoid errors or delays.

Individual income tax filing includes reporting salary, freelance earnings, rental income, and investment returns. Accurate reporting ensures correct tax calculation and smooth processing of tax refunds. Online systems automatically calculate tax liability, making it easier to file tax return without professional assistance in many cases.

Business tax applies to companies, partnerships, and self-employed individuals. Filing a business tax return involves reporting:

Accurate business tax filing ensures compliance and helps businesses plan finances more effectively.

After completing your income tax filing, you may need to pay taxes online if there is outstanding tax liability.

Most tax portals offer multiple online payment options, including bank transfers and digital wallets.

A tax refund occurs when the tax you paid during the year exceeds your actual income tax liability. Refunds are processed after your income tax return is reviewed and approved.

Refund timelines vary, but online filing generally results in faster processing compared to manual submissions.

Avoid these errors to ensure smooth income tax filing:

Filing your tax return on time is crucial. Late income tax filing may lead to:

Effective tax planning can reduce your income tax burden:

Filing a tax return is more than a legal obligation it’s a smart financial habit. Whether you are filing an income tax return, managing business tax, or waiting for a tax refund, proper planning and accurate filing are key. With online systems making it easier to file income tax return and pay taxes online, staying compliant has never been more convenient. Regular and accurate income tax filing helps individuals and businesses maintain financial transparency, avoid penalties, and achieve long-term financial success.

We empower businesses across Pakistan with secure, efficient, and regulation-ready billing solutions, making tax compliance simpler, faster, and smarter.

© 2025 Tax Jar. All Rights Reserved

WhatsApp us