Businesses are under constant pressure to improve efficiency, accuracy, and financial transparency. Traditional paper-based invoicing methods are no longer sufficient for modern organizations that need speed, automation, and real-time visibility into their finances. This is where the digital invoice comes into play. Digital invoicing has transformed how businesses create, send, approve, and process invoices, replacing manual workflows with automated, secure, and scalable solutions. From small businesses to large enterprises, companies across industries are rapidly adopting digital invoicing to reduce operational costs, eliminate errors, and accelerate payment cycles. This comprehensive guide explores everything you need to know about digital invoices, including digital invoice templates, digital invoice formats, invoice digitization, digital invoice approval, and modern tools like digital invoice apps that help businesses fully digitize invoices.

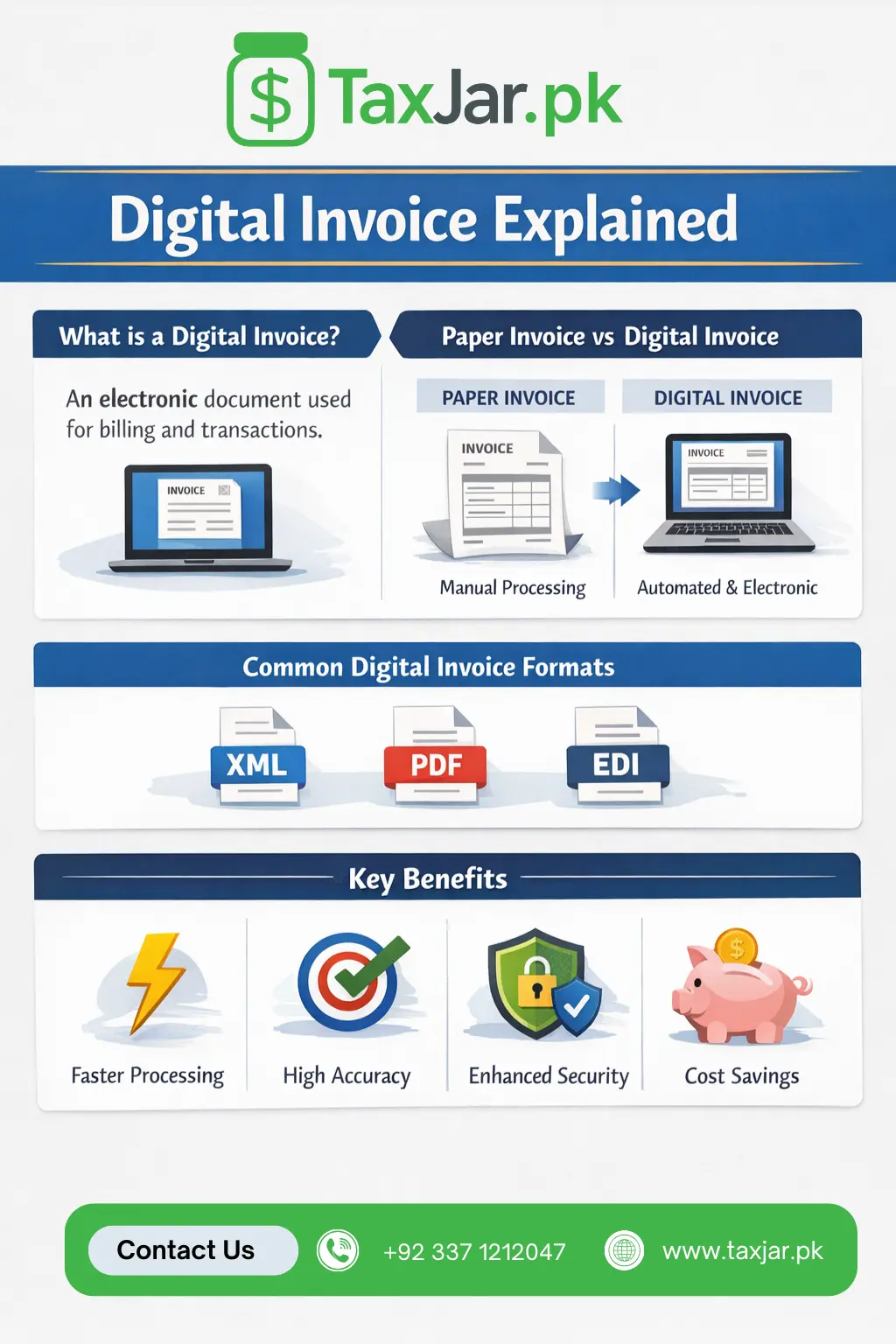

A digital invoice is an electronic version of a traditional paper invoice that is created, sent, received, and stored in a digital format. Unlike scanned paper invoices or PDFs emailed manually, true digital invoices are generated through invoicing software and are designed to be processed automatically by accounting and enterprise systems. Digital invoices contain structured data such as vendor information, invoice numbers, line items, tax details, and payment terms, allowing systems to read and process them without human intervention. This structure enables faster digital invoice processing, improves data accuracy, and provides real-time financial insights for businesses.

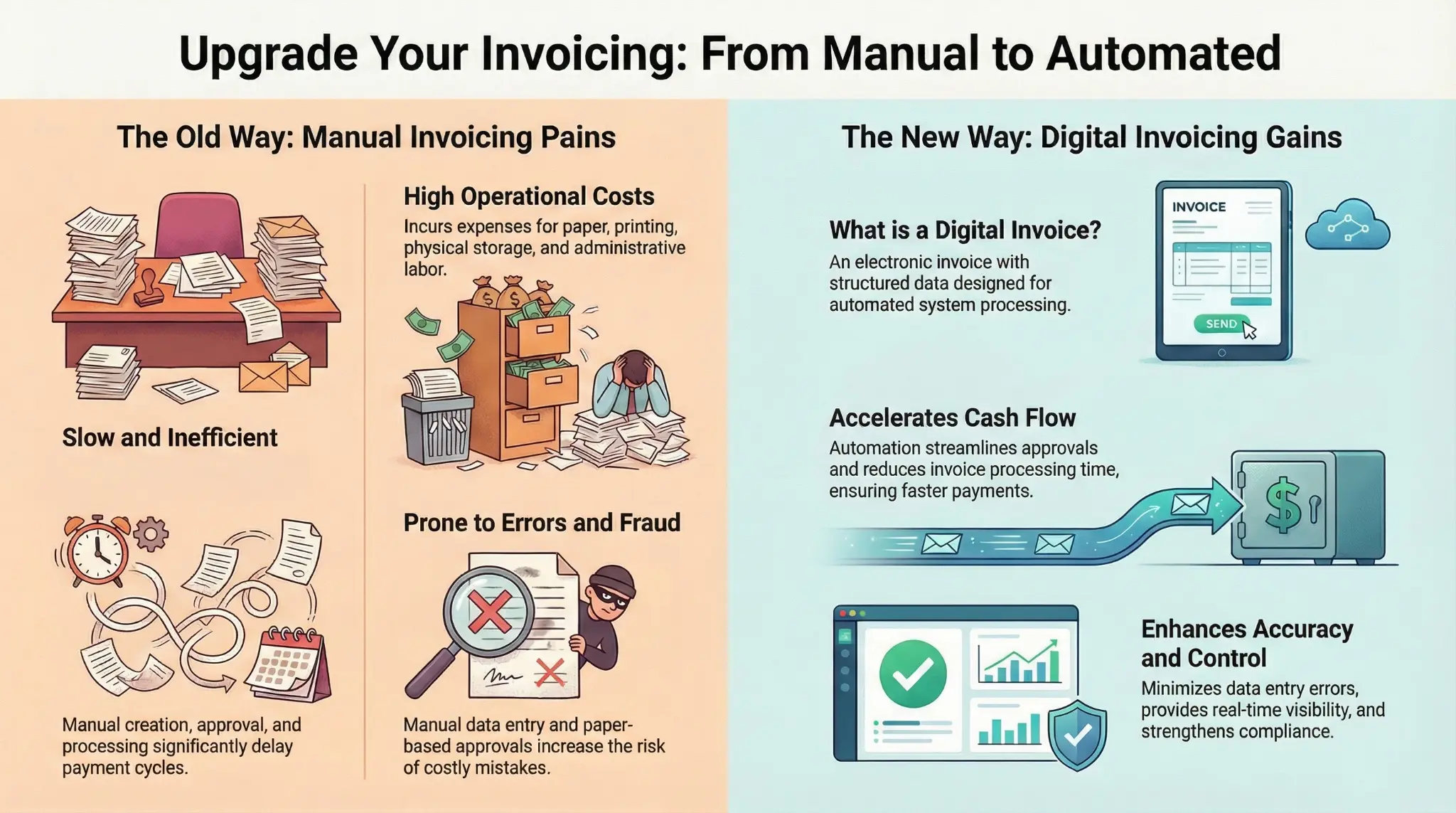

The shift toward digital invoicing did not happen overnight. Businesses initially relied on paper invoices, which were slow, expensive, and prone to errors. As email became common, companies moved to PDF invoices, but these still required manual data entry and approval workflows. With advancements in automation, cloud computing, and artificial intelligence, digital invoicing systems emerged as a smarter solution. Today, modern invoicing platforms combine invoice digitization, workflow automation, and analytics to create a seamless end-to-end invoicing experience that supports scalability and compliance.

Digital invoicing is no longer a luxury, it is a necessity. Manual invoicing processes consume time, increase administrative costs, and expose businesses to errors and fraud. By adopting digital invoices, organizations can significantly streamline operations and improve financial control. Key benefits of digital invoicing include faster invoice creation, reduced processing costs, improved accuracy, enhanced cash flow, and better compliance with tax and regulatory requirements. Additionally, digital invoicing supports remote work environments by enabling cloud-based access and approvals from anywhere.

A digital invoice template is a pre-designed, standardized invoice layout that businesses use to create consistent and professional invoices. These templates include essential fields such as seller details, buyer information, invoice date, line items, tax calculations, and payment instructions. Using a digital invoice template ensures uniformity across all invoices, reduces the risk of missing information, and speeds up invoice creation. Most digital invoicing platforms offer customizable templates that can be tailored to match branding requirements while maintaining compliance with local and international invoicing standards.

The digital invoice format refers to how invoice data is structured and stored electronically. Common formats include XML, JSON, EDI, and standardized e-invoicing formats required by tax authorities in many countries. Unlike PDFs, these formats allow automated systems to read and process invoice data without manual input. Choosing the right digital invoice format is critical for seamless integration with accounting software, ERP systems, and payment platforms. Structured formats also enable faster digital invoice processing and support advanced features such as real-time validation and automated tax reporting.

Invoice digitization is the process of converting paper or unstructured invoices into digital, machine-readable formats. This process typically involves scanning invoices and using optical character recognition (OCR) technology to extract relevant data automatically. Invoice digitization is often the first step for businesses transitioning from manual invoicing to full digital invoicing. By digitizing invoices, companies can eliminate physical storage, reduce manual data entry, and create searchable digital records that improve audit readiness and financial transparency.

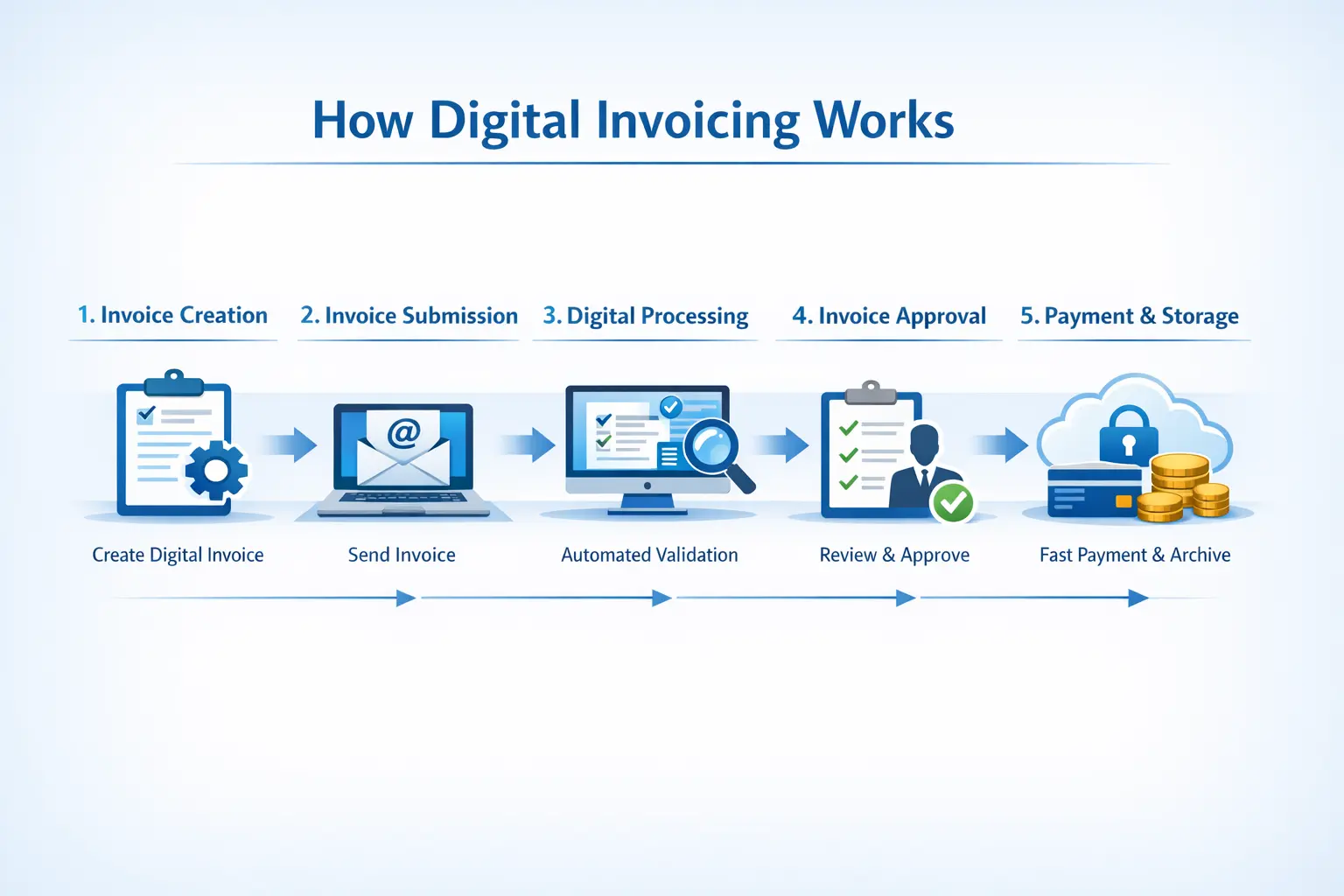

Digital invoice processing automates the entire lifecycle of an invoice from receipt to payment. Once an invoice is generated or received digitally, the system validates the data, matches it against purchase orders or contracts, and routes it for approval based on predefined rules. Automation significantly reduces processing time, minimizes errors, and ensures compliance with internal controls. Advanced digital invoice processing systems use AI and machine learning to detect anomalies, prevent duplicate payments, and continuously optimize workflows.

A well-defined digital invoice approval process is essential for maintaining financial control and preventing unauthorized payments. Digital approval workflows route invoices to the appropriate stakeholders based on invoice value, department, or vendor type. Unlike manual approvals that rely on emails or paper signatures, digital invoice approval provides real-time visibility, automated reminders, and audit trails. This ensures faster approvals, improved accountability, and complete transparency across the organization.

A digital invoice app allows businesses to create, send, receive, and manage invoices using mobile devices or cloud-based platforms. These apps are especially useful for small businesses, freelancers, and remote teams that need flexibility and mobility. Digital invoice apps often include features such as invoice templates, automated reminders, payment tracking, and integration with accounting software. By using a digital invoice app, businesses can digitize invoices on the go and maintain full control over their invoicing processes.

To digitize invoices effectively, businesses should start by selecting the right invoicing or document management software. The process typically involves scanning paper invoices, extracting data using OCR, validating the information, and storing it securely in a digital repository. Successful invoice digitization also requires clear workflows, staff training, and integration with existing financial systems. When done correctly, digitizing invoices reduces administrative workload and lays the foundation for full digital invoicing automation.

Security is a critical consideration in digital invoicing. Digital invoices must be protected against unauthorized access, data breaches, and fraud. Modern invoicing systems use encryption, access controls, and audit logs to safeguard sensitive financial data. Compliance is equally important, as many countries mandate specific digital invoice formats and reporting requirements. A robust digital invoicing solution ensures compliance with tax laws, data protection regulations, and industry standards while simplifying audits and reporting.

While digital invoicing benefits businesses of all sizes, the implementation approach may differ. Small businesses often use simple digital invoice apps and templates to streamline billing and improve cash flow. Large enterprises require advanced digital invoice processing systems that integrate with ERP platforms and handle high invoice volumes. Regardless of size, the core advantages of digital invoicing speed, accuracy, and visibility remain the same, making it a valuable investment for any organization.

The future of digital invoicing lies in increased automation, real-time data exchange, and global standardization. Technologies such as artificial intelligence, blockchain, and advanced analytics will further enhance invoice digitization and processing capabilities. As governments and tax authorities continue to adopt mandatory e-invoicing regulations, businesses that invest in digital invoicing today will be better positioned to adapt and remain compliant in the future.

A digital invoice is far more than a paper invoice in electronic form it is a critical component of modern financial operations. By adopting digital invoicing, using standardized digital invoice templates, implementing efficient digital invoice processing, and embracing invoice digitization, businesses can achieve greater efficiency, accuracy, and financial control. From streamlined digital invoice approval workflows to flexible digital invoice apps, digitizing invoices empowers organizations to reduce costs, improve cash flow, and scale with confidence. As digital transformation continues to reshape business operations, digital invoicing stands out as a foundational tool for long-term success.

We empower businesses across Pakistan with secure, efficient, and regulation-ready billing solutions, making tax compliance simpler, faster, and smarter.

© 2025 Tax Jar. All Rights Reserved

WhatsApp us