Income Tax & Auditing Services in Pakistan provide individuals and businesses with professional support to meet FBR compliance requirements and manage tax audit challenges successfully. Our expert team specializes in income tax audits, audit tax advisory, and preparation of accurate tax audit reports, ensuring transparency, risk reduction, and full compliance with Pakistan’s tax laws. Whether you are facing an FBR audit or need proactive audit advisory services, we help you protect your financial interests with confidence and clarity.

Income Tax & Auditing Services in Pakistan are essential for individuals, companies, and growing businesses to remain fully compliant with Federal Board of Revenue (FBR) regulations while effectively managing tax risks. Our comprehensive services are designed to support taxpayers at every stage of the audit and compliance process, from routine income tax review to complex tax audit cases. We provide complete assistance in income tax audits, audit tax advisory, and preparation of accurate tax audit reports, ensuring financial transparency and regulatory accuracy. By identifying discrepancies early, addressing compliance gaps, and aligning financial records with Pakistan’s tax laws, we help clients reduce penalties, avoid unnecessary disputes, and maintain long-term tax compliance with confidence.

We offer professional income tax audit services to businesses and individuals selected for audit by the Federal Board of Revenue (FBR). Our experienced tax professionals thoroughly review financial records, tax returns, and supporting documents to identify discrepancies, errors, or compliance gaps. We ensure that your income tax audit is handled efficiently and professionally with minimal disruption to your business operations.

Our audit tax advisory services focus on proactive compliance and risk management. We guide clients on tax laws, audit preparedness, and best practices to avoid penalties or unnecessary objections. From responding to FBR notices to aligning records with tax regulations, our advisory services help you stay compliant before, during, and after a tax audit in Pakistan.

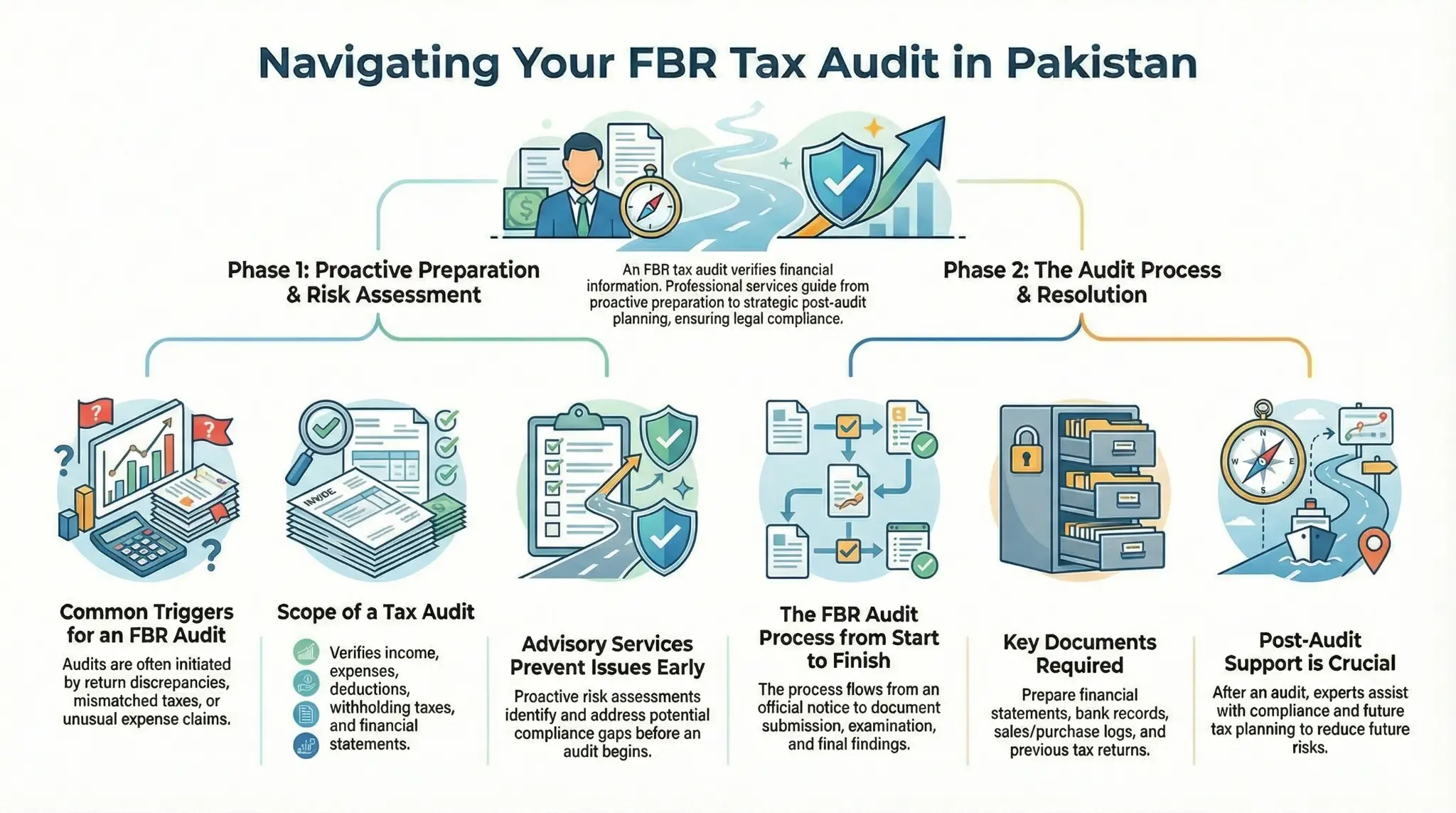

Tax audits in Pakistan are conducted under the Income Tax Ordinance, 2001. FBR may select taxpayers for audit based on risk profiling, discrepancies, or random selection. Our team ensures complete compliance with FBR audit requirements, timelines, and documentation standards, helping you navigate the audit process smoothly and confidently.

Preparing an accurate income tax audit report is a critical part of the audit process. We prepare detailed and FBR-compliant tax audit reports that clearly present financial data, tax positions, and justifications. Our reports reduce the chances of objections, penalties, or prolonged audit proceedings and support transparent communication with tax authorities.

We conduct comprehensive tax risk assessments to identify potential exposure areas before they escalate into serious issues. In case of disputes, objections, or audit findings, we assist in tax dispute resolution by preparing replies, supporting evidence, and representations before FBR authorities to protect your financial interests.

We trust technical expertise with practical experience to deliver reliable tax audit solutions. Our focus is on accuracy, compliance, and client satisfaction. Whether you are an individual taxpayer or a corporate entity, our income tax and auditing services are tailored to meet your specific needs while confirming peace of mind.

The scope of an income tax audit includes verification of income, expenses, deductions, tax credits, withholding taxes, and financial statements. We ensure all reported figures align with supporting documents and applicable tax laws to avoid unnecessary audit complications.

The FBR income tax audit process typically starts with an audit notice, followed by document submission, examination, queries, and final findings. Our experts guide you through every step, ensuring timely responses and proper representation throughout the audit process.

Common documents required for a tax audit in Pakistan include:

We help organize and review all documents to ensure completeness and accuracy.

Income tax audits are often triggered by discrepancies in returns, mismatched withholding taxes, unusual expense claims, or inconsistencies in financial data. Our advisory services help identify and address these issues proactively.

Our audit tax advisory services cater to salaried individuals, freelancers, SMEs, and corporate entities. We provide personalized guidance based on your tax profile to reduce audit risks and ensure long-term compliance.

We handle the complete preparation and submission of tax audit reports, ensuring they meet FBR standards and deadlines. Our structured approach helps prevent re-audits and unnecessary follow-ups.

Receiving an FBR notice can be stressful. We professionally handle FBR audit notices, prepare replies, and address objections with proper legal and financial justification to protect your rights as a taxpayer.

After the audit, we assist with post-audit compliance and future tax planning. Our goal is to strengthen your tax structure, reduce future audit risks, and ensure smooth compliance in upcoming tax years.

Confirm accurate financial reporting, strong tax compliance, and stress-free income tax audits with our professional tax audit services in Pakistan. Our experienced tax advisors provide complete support for income tax audits, audit advisory, and FBR compliance, helping individuals and businesses respond confidently to audit notices and regulatory requirements. From audit preparation to post-audit support, we ensure transparency, risk reduction, and long-term tax compliance so you can focus on growing your business with peace of mind.

We empower businesses across Pakistan with secure, efficient, and regulation-ready billing solutions, making tax compliance simpler, faster, and smarter.

© 2025 Tax Jar. All Rights Reserved

WhatsApp us